As a PPC agency or consultant, you may be looking for ways to boost client acquisition and improve your prospecting strategy. Lots of articles out there promise secret tips and tricks for getting new PPC clients. They might tell you to encourage referrals, personalize proposals, or promote case studies. However, few will offer a detailed method for using prospecting software to find and secure new PPC clients.

In this guide, we will give you this method, and we will show how you can:

- Spot the underperforming PPC advertisers in any niche or location

- Benchmark your existing prospect against their competitors

- Uncover PPC data which helps your prospect build profitable campaigns

- Add extra value within your reports by using competitive intelligence

Ultimately, you want to get more PPC clients through the door — and this article will show how you can use iSpionage not just for competitive research, but also as PPC prospecting software.

How to Find New PPC Prospects

Prospects for your PPC agency may come via referrals, contacts, and/or inbound marketing channels, but if you’re looking to grow your agency using outreach and sales calls, iSpionage SEM Campaign Watch will help you identify which PPC advertisers are in need of your expertise to improve their campaign ROI.

Finding PPC Prospects in a Niche & Location

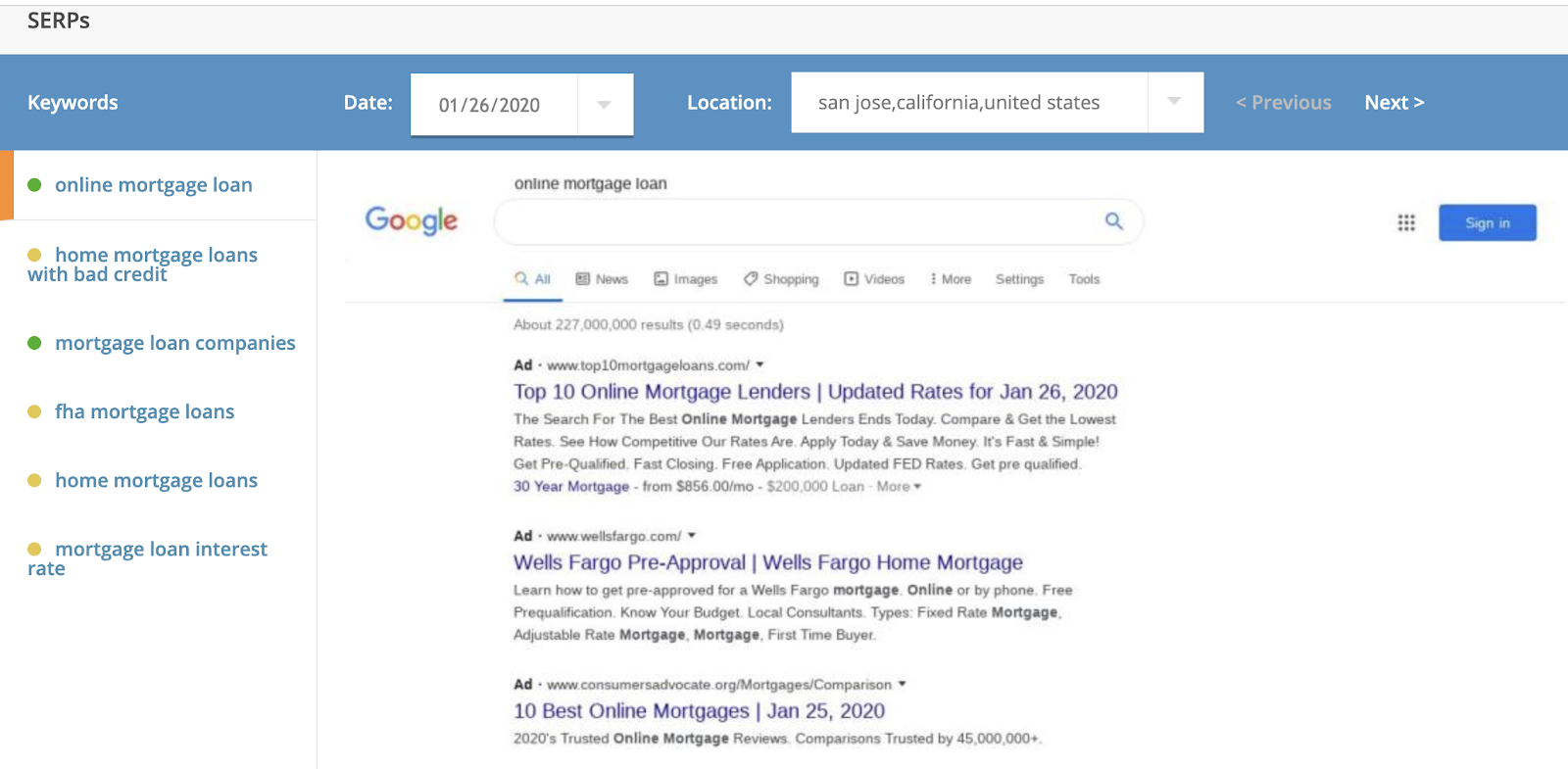

In order to find prospects in a specific location, you’ll need to know the set of keywords that PPC advertisers are targeting. So, you’ll need to decide on your niche first — and you can do keyword research using Google Keyword Planner or iSpionage Competitor Research to refine your keyword set.

Next, you can use SEM Campaign Watch to input these keywords and find advertisers with a weak PPC strategy in any town, city, or region.

(Keep in mind: we’ve made all of the images in this post clickable so that you can get a better look at everything.)

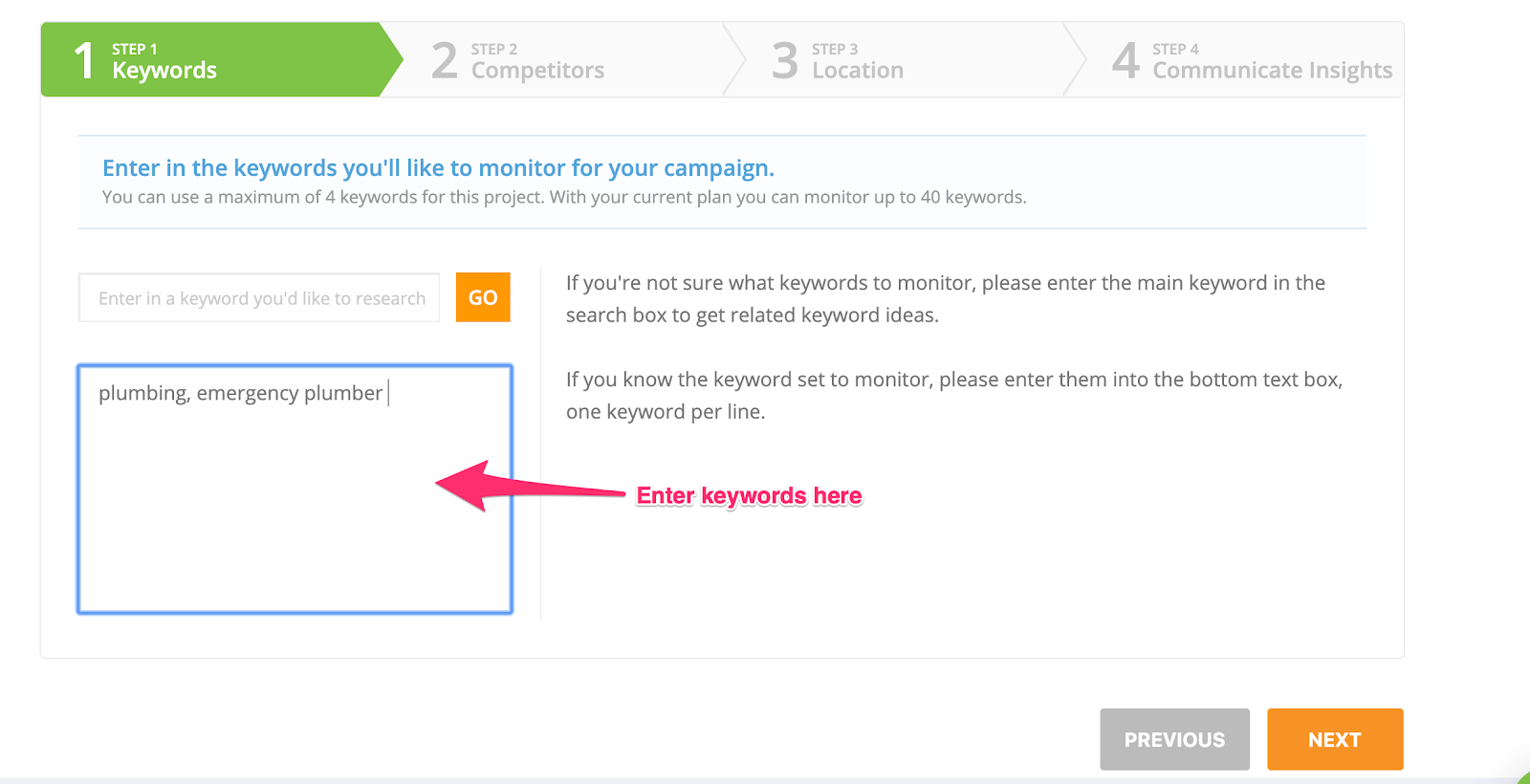

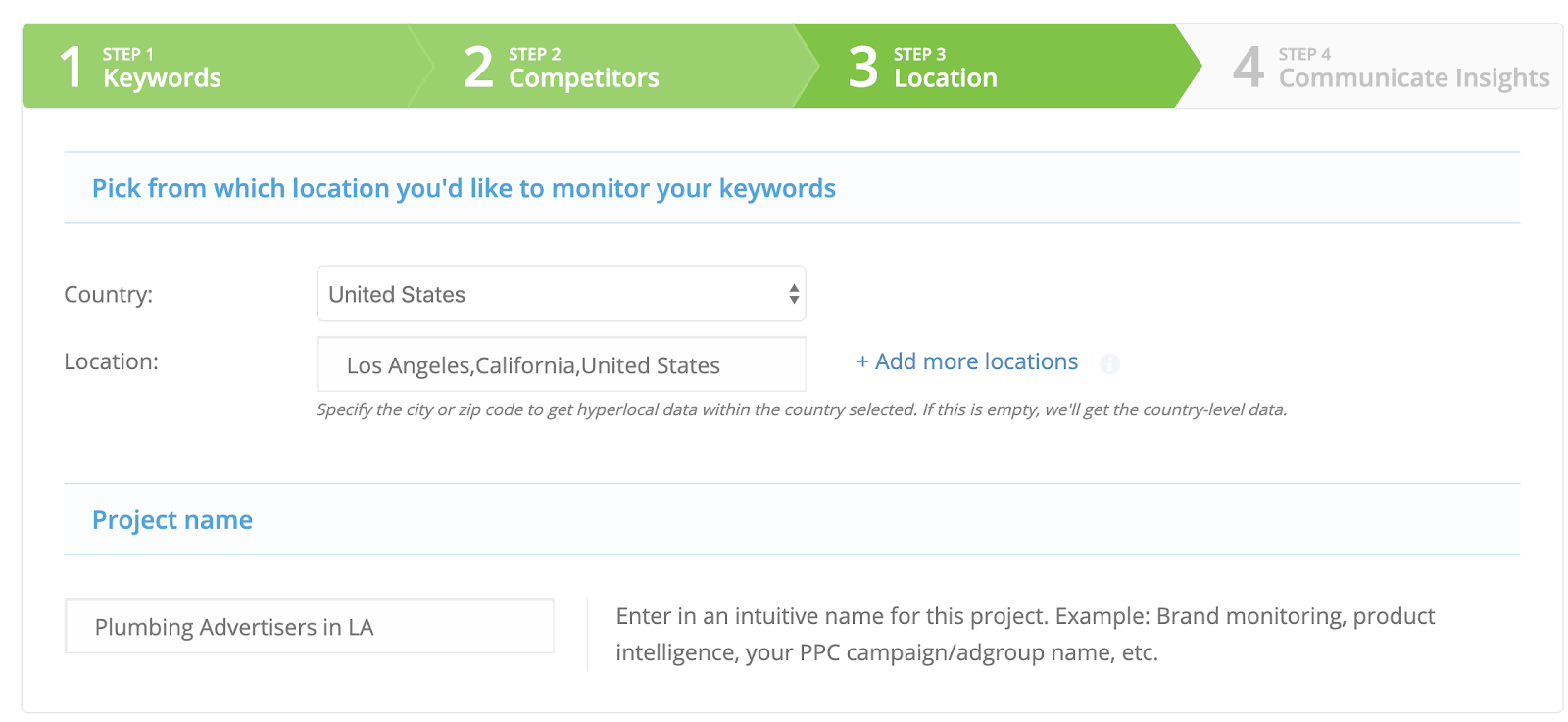

Let’s say your PPC agency has a penchant for home services, and you’re looking for a new plumbing client in your hometown of Los Angeles. When setting up SEM Campaign Watch, you simply input your keywords — e.g. “plumber” and “emergency plumber”, and set the location to Los Angeles, California.

In step 1: Add the keywords you’re looking to target.

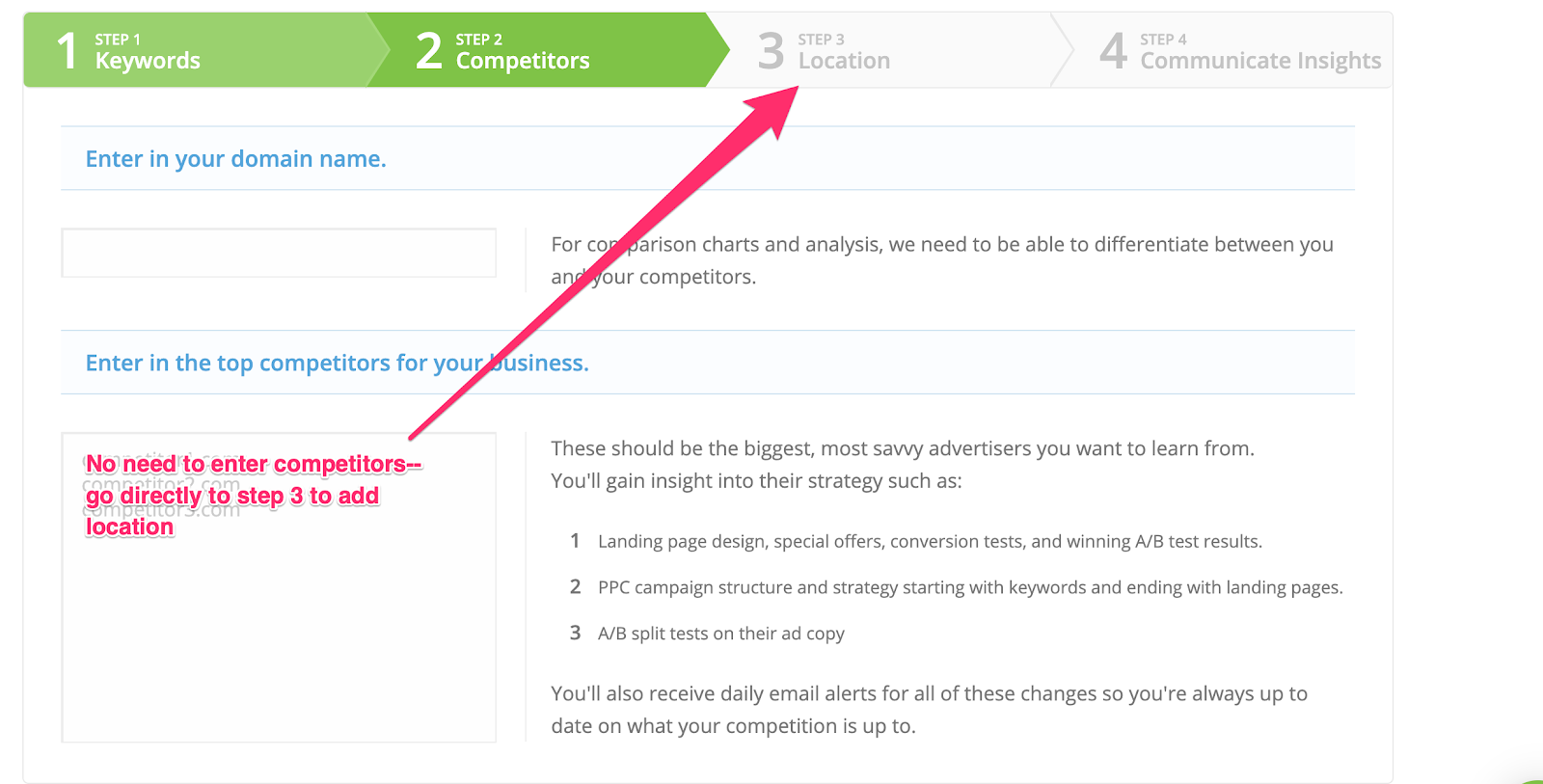

Step 2: For this use case of finding PPC prospects, you don’t need to add your own domain or any competitors.

Then add location data in Step 3: Enter in Los Angeles, California

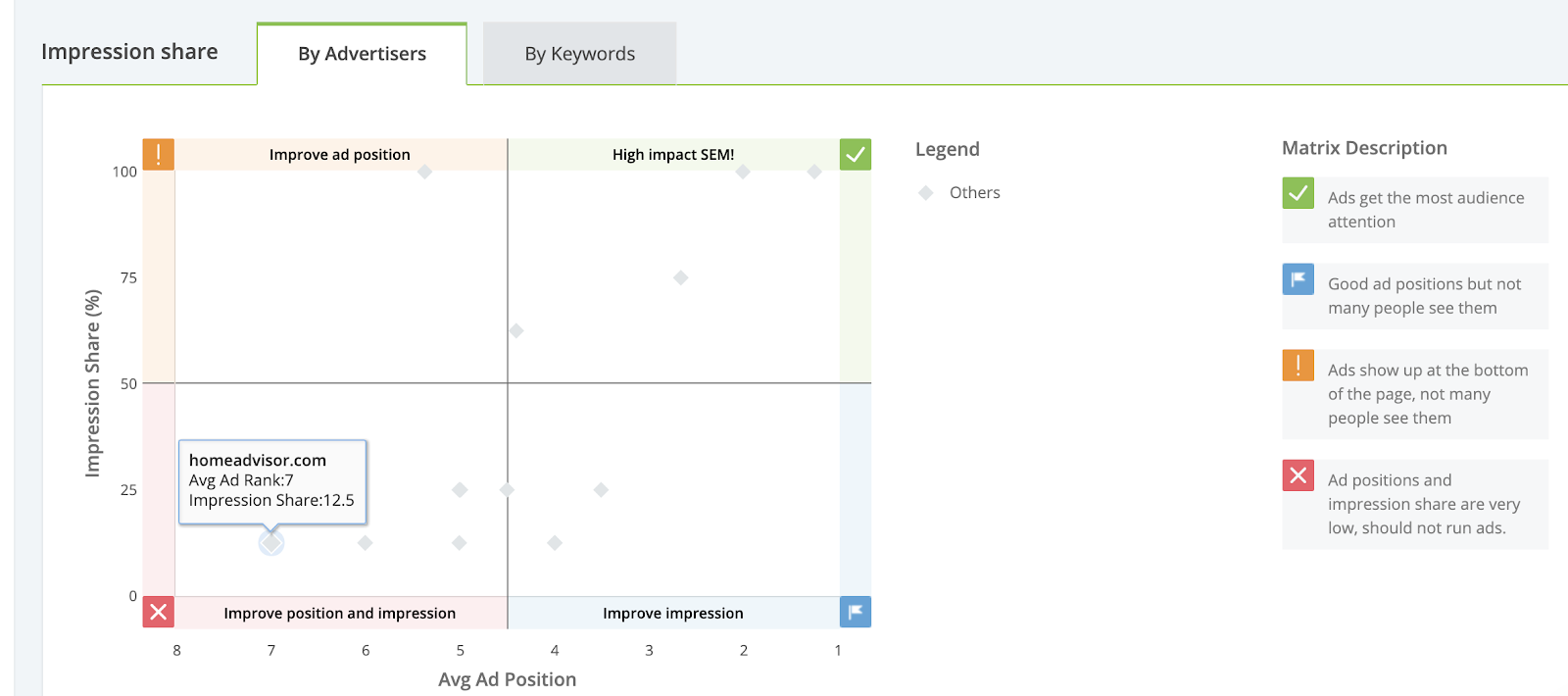

The tool will crawl the SERPs automatically and pull up a list of the advertisers who target those keywords in L.A:

We can see that there are five advertisers in the bottom-left quadrant — meaning their ad positions and impression share is extremely low, which indicates that they’re running low-performance PPC campaigns for the “plumber” keywords. Therefore, these businesses are ideal candidates for sales outreach, because they clearly want to get results from paid search — but they’re not currently seeing ROI.

Your agency can help these companies achieve a more profitable Google Ads (Google AdWords) setup — especially when you come armed with real competitor intelligence and market insights.

And next up, we’ll look at how you can access this data — and how to use it to convert your prospects. We’ll show you how to dig into the keywords, ads, and landing pages of prospects and competitors in order to benchmark them, create a plan of action, and build a case for your agency to secure the client.

Sign up for a free iSpionage account to access national and local PPC data and get a snapshot of the competitive landscape for your chosen niche. Upgrade to Starter or Professional for Campaign Watch.

How to Turn Prospects Into Clients: Real Competitor & Market Insights

You may have approached an underperforming advertiser after using SEM Campaign Watch (as above), or you may have made contact with a prospect through another channel. Either way, you’re in a position where you need to impress your prospect and build trust within a tight timeframe.

You’ll often have the pressure of knowing that other agencies are vying for the same PPC client, so how do you set your agency apart? One way to be unique is to provide real competitor and market insights, and to benchmark your prospect against the highest-performing advertisers in their niche and location.

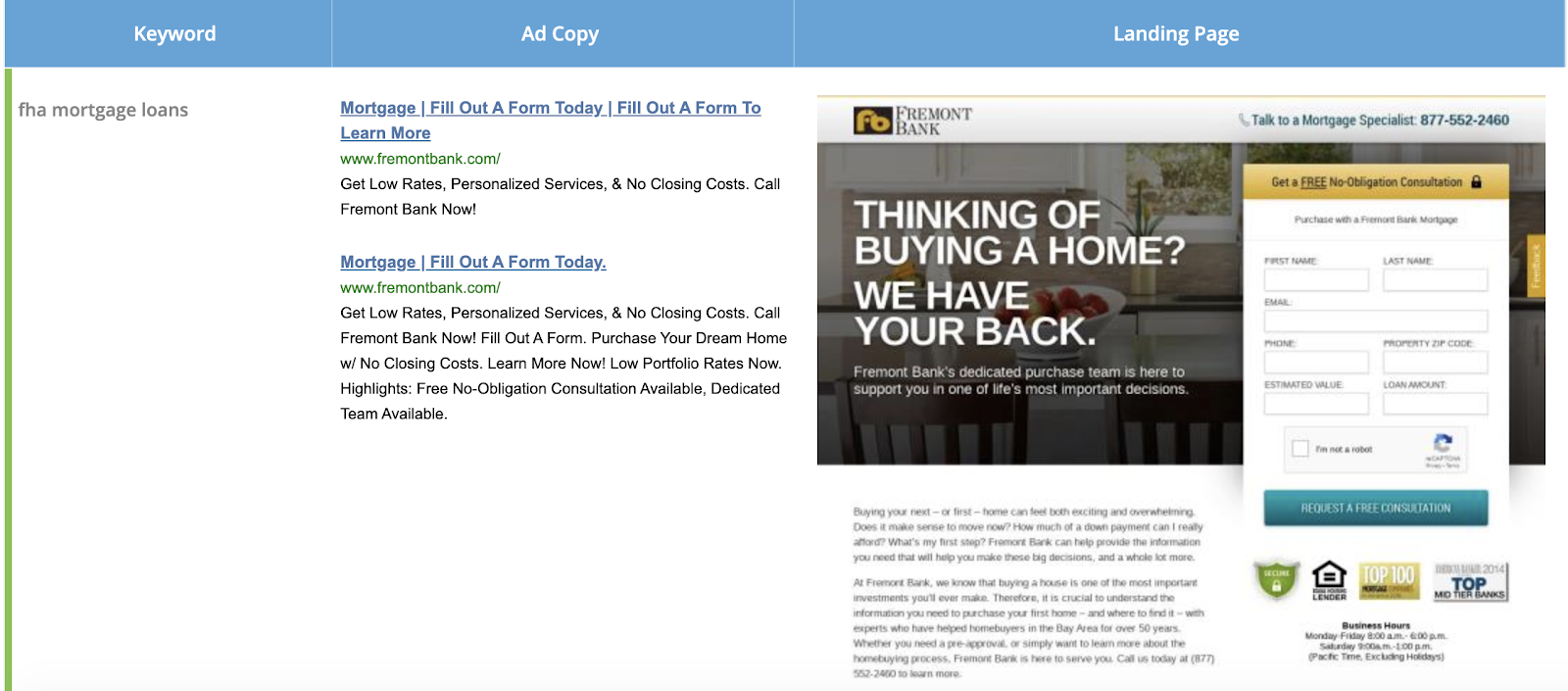

Let’s say I’m a PPC consultant and I’ve met with a digital marketing lead from Fremont Bank in California. I’ve been given a few days to create a pitch to win the contract for their Google Ads management.

First, I need to narrow down the keywords they want to target. Financial institutions have a ton of products, but my prospect is interested in targeting “mortgages” and “home loans” keywords in the Fremont area.

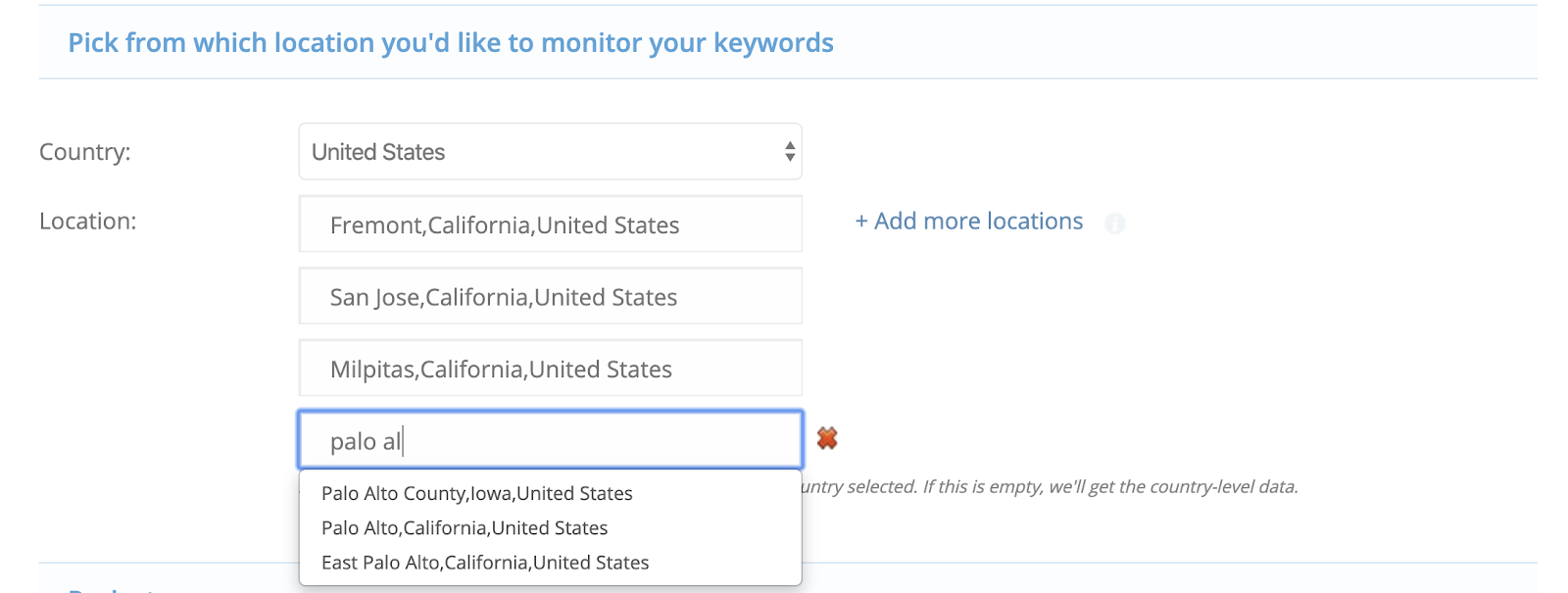

Once these keywords are defined, I go to SEM Campaign Watch, add them into the tool alongside the Fremont Bank URL, and choose areas around Fremont — San Jose, Milpitas, Palo Alto, etc.

Note: Campaign Watch starts to show data within 3-4 hours, but we recommend waiting at least 24 hours while the tool gathers all the data about advertisers for your keyword(s) in your chosen location(s).

What we need to understand about our prospect is:

- Who is Fremont Bank competing against in the paid search results?

- What do competitors offer, and how do they structure their value proposition?

- How can Fremonk Bank be different and/or better than competitors?

With this information, I can build trust quickly and position my agency as a business advisor — rather than simply a team that builds and monitors PPC campaigns. And I can create a PPC proposal that not only references my past clients, but uses real and relevant data to set the foundations for a PPC strategy.

Uncovering the Real Competitive Landscape

After entering your keywords and your prospect’s URL, SEM Campaign Watch will generate a report which pulls through all the PPC competitors in your chosen location. Many agencies will already know their prospect’s main competitors, and can therefore enter these competitor domains in at the setup phase. iSpionage will pick up other advertisers automatically, which you can then add to the list.

From this dashboard, you gain a full picture and dig into the ads, A/B tests, and landing pages of your prospect and their competitors — things otherwise hidden away within their Google Ads accounts.

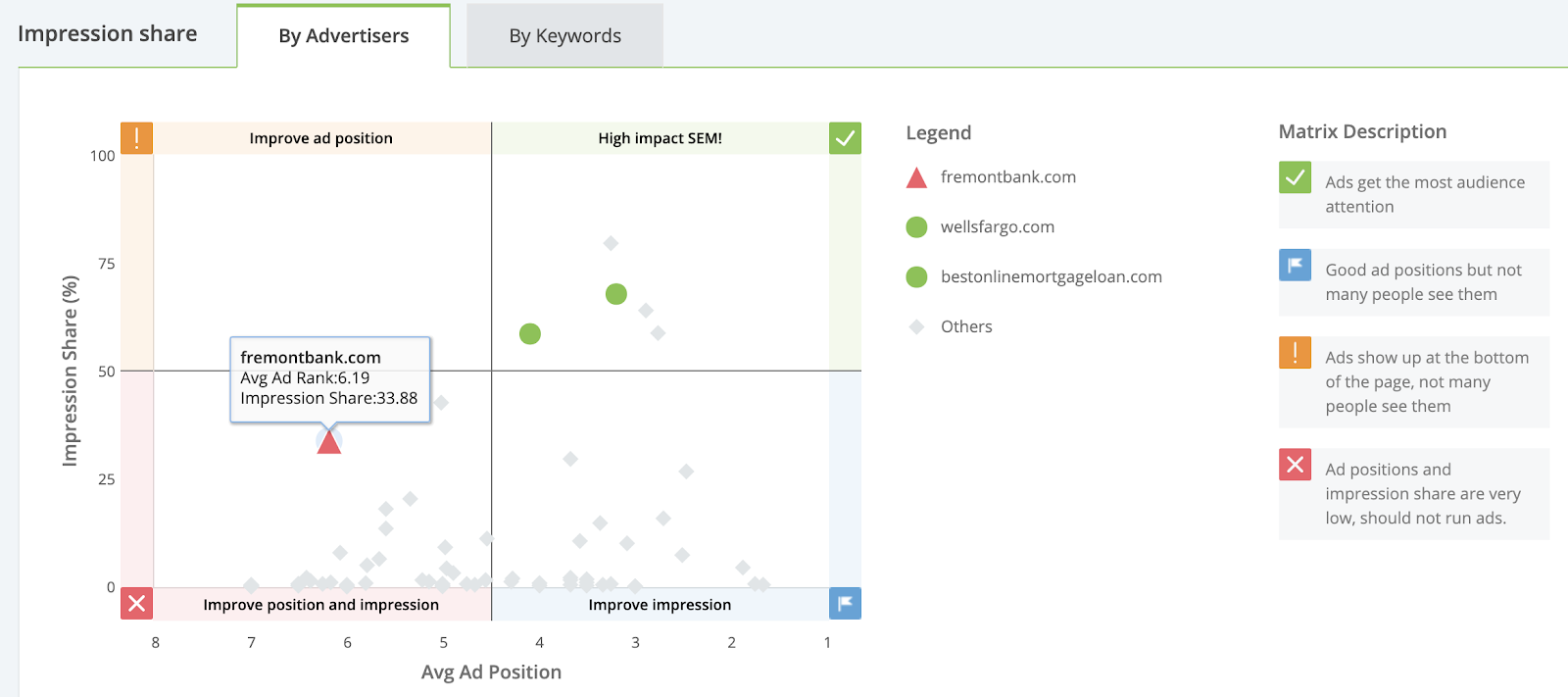

We can see that Fremont Bank is in the bottom-left quadrant, indicating that they need to improve their average ad position (6.19) and impression share (33.8%). But how can this be done? Some of the answers may lie in what the best-performing competitors are doing on Google Ads, so let’s take a look.

Benchmarking Your Prospect Against Competitors

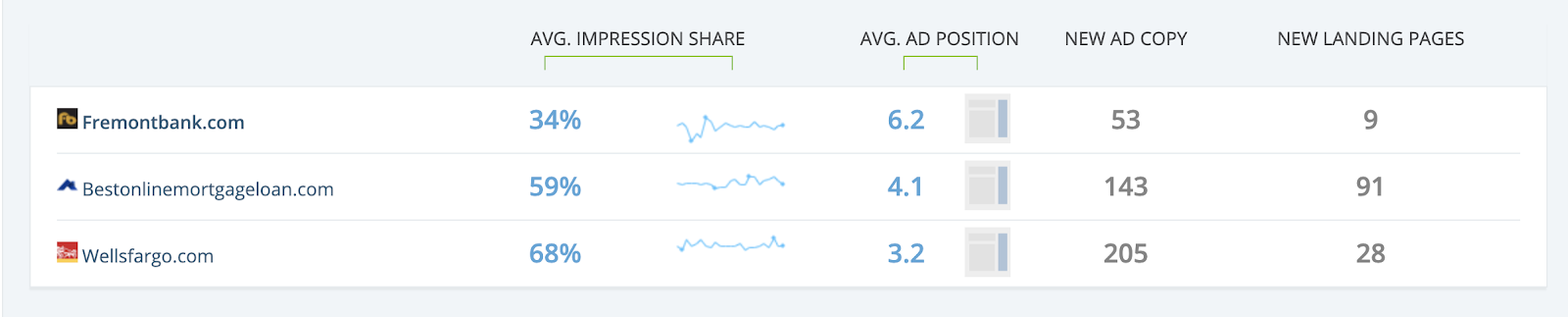

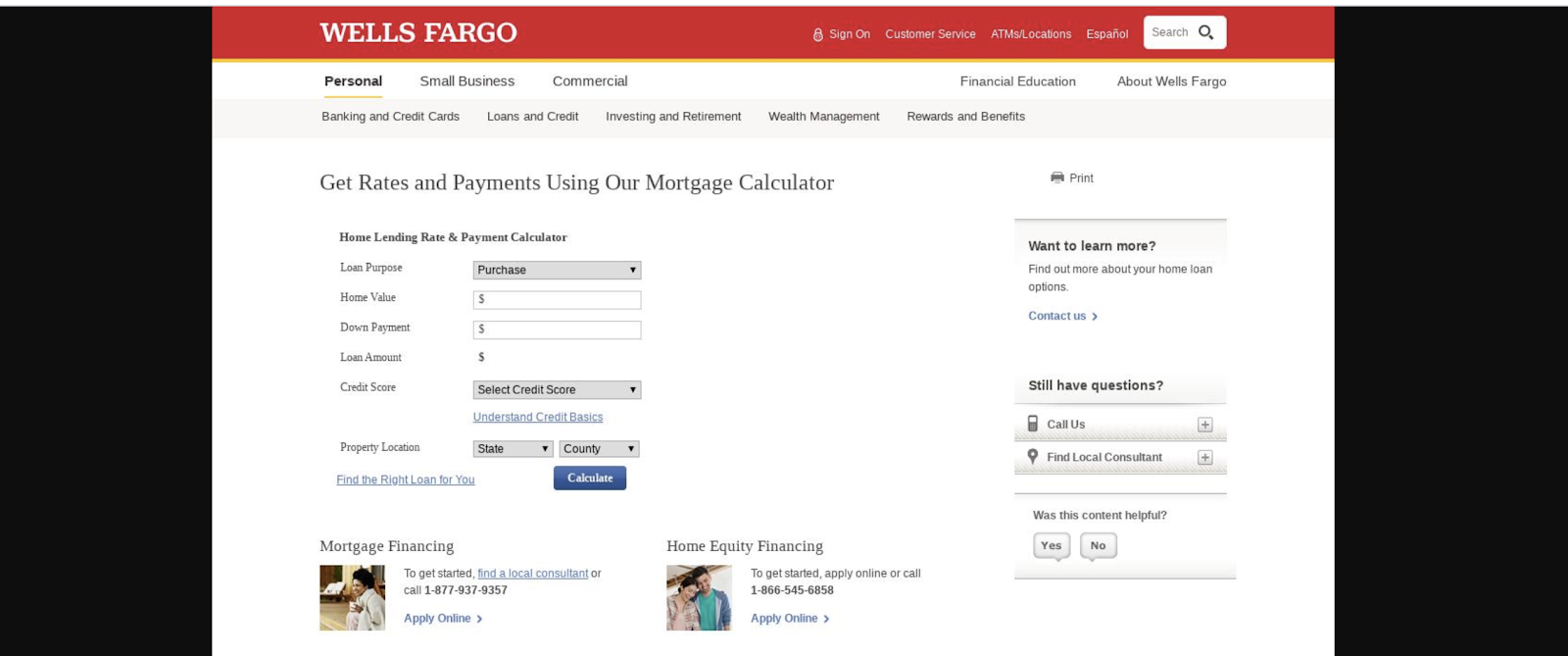

From the quadrant graph and the list of advertisers, we can see that Wells Fargo has a high impact SEM strategy. To understand what they’re doing to set them apart from Fremont Bank and other advertisers, we can review their ad copy and landing pages, and track their full user journey within one dashboard.

In this single view, iSpionage covers the three aspects that need to align seamlessly for any profitable Google Ads campaign:

- The keyword, i.e. the searcher’s problem

- The ad copy, i.e. the promise to solve their problem

- The landing page, i.e. the place where you solve their problem

Note: iSpionage is currently the only software for PPC prospecting and competitor research that gives you this visual insight into the full user journey — including landing page snapshots.

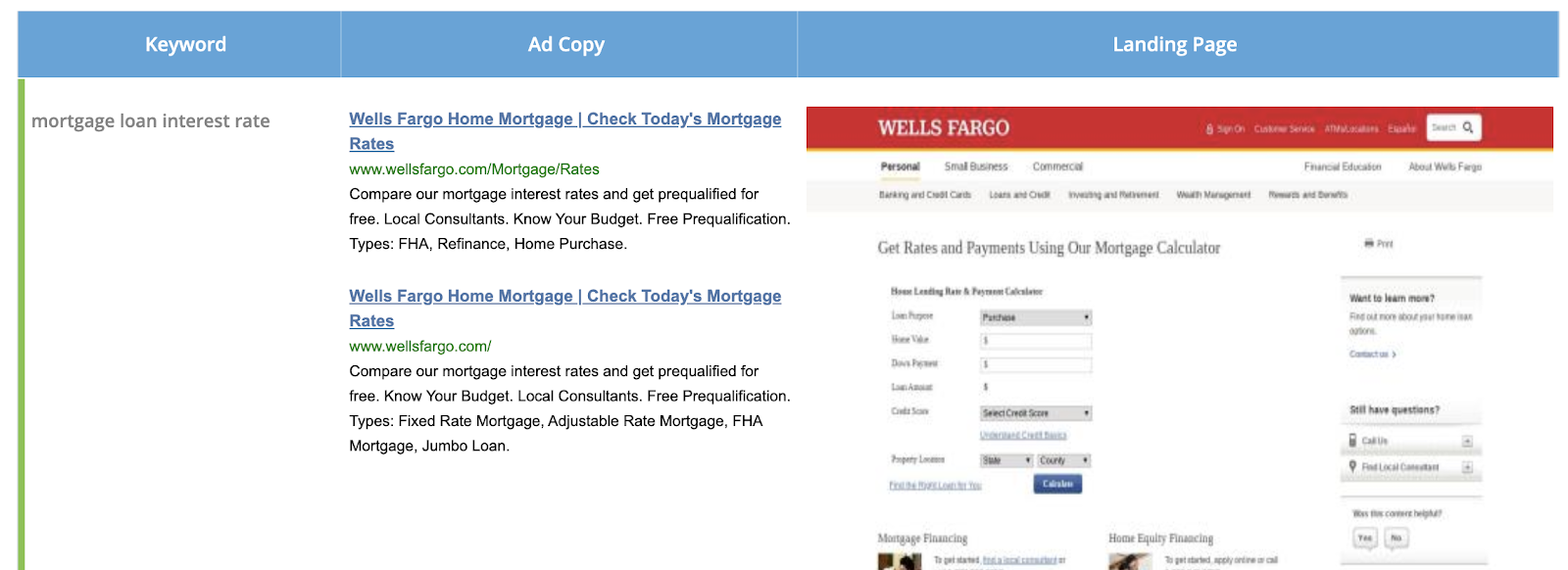

When we look at the Wells Fargo user journey, we see the following characteristics:

- A landing page with a built-in calculator widget — engaging and valuable to a user

- Close alignment between keyword, ad copy, and landing page offer

- Keywords are mentioned in the ad’s destination URL

- Compelling ad copy, featuring terms like “free” and “local”

Within this dashboard, we can also see variants of the user journey. For Wells Fargo, we see that they’re actually testing another landing page built for the same keywords and ad copy — one with the widget replaced by a comparison table. This means you can track A/B tests and report on which combination wins, learning key lessons before your prospect has had to spend any of their own budget on tests.

But the Wells Fargo data — and the data we can pull from other competitors — becomes even more meaningful when benchmarked against your prospect, so as well as researching high-performing competitors in the niche, we need to compare what they do with what Fremont Bank has been doing.

Sign up for a free iSpionage account to access nationwide PPC data and get a snapshot of the competitive landscape for your chosen niche. Upgrade to Starter or Professional for Campaign Watch.

The Right Pitch: Is Your Prospect Ready for More Paid Search Traffic?

You can always promise to alter the keyword set, tweak budget distribution, and create compelling ad copy — but none of this matters if your client’s website doesn’t convert the visitor. And it’s hard for your agency to retain a client for the long-term if they’re not seeing ROI from Google Ads.

So as a consultant, the first thing you’ll decide is whether your prospect is actually ready to convert more traffic into leads through their website:

What we immediately see on the Fremont Bank user journey is:

- No added-value information on the landing page — just the contact form

- “Fill out a form today” — not a very compelling ad copy idea

- Mixed messaging in the ad and landing page — should I click, fill out a form, or call them?

When we contrast these characteristics with other top PPC competitors for mortgage keywords in the area, it’s clear that work must be done on the offer and the designs before we’d launch new campaigns.

And by using the data provided by iSpionage, you can create a plan for improving Fremont Bank’s click-through rate (CTR) in line with real competitors, thereby encouraging Google to boost their ad positions and impression share. At the same time, you can provide a bigger-picture view of the competitive landscape for paid search results in the prospect’s town, city, region, state, or country.

Your proposal to Fremont Bank can now include the following:

- Real market intelligence, including keyword sets and ad copy from leading competitors

- Examples of best-in-class ads and landing page designs (e.g. snapshots from Wells Fargo)

- Local competitor data, not just nationwide PPC bidders (Fremont-specific advertisers)

- Competitor A/B test results for ads and landing page offers

- Benchmarked PPC performance of the prospect vs. all top competitors in the niche

Deeper Reporting: Adding Value to Become a Trusted Advisor & Partner

When you pitch and show what you’ll deliver, it’ll probably involve setting up campaigns and ad groups, creating ad copy, A/B testing ads, trying out new keywords, and perhaps even designing new landing pages. However, once your new client has a well-oiled Google Ads machine, your agency must promise to add value on top of campaign tweaks and general monthly management.

The same SEM Campaign Watch project that you set up for the prospecting stage will continue to monitor the competitive landscape over time, so you can provide this extra value by extending your reporting scope to cover market shifts, competitor activity, patterns in the paid search results (see screenshot below), and new PPC keyword opportunities.

Many digital agencies will promise to stay on top of their prospect’s PPC, but few will provide this level of market intelligence in their monthly reporting. And this data will also help you lay out a roadmap for your prospect, showing how you can progress from initial quick wins to long-term PPC success. You show that you’re invested in their ongoing profitability, rather than just in “setting and forgetting”.

Key Takeaways

Using SEM Campaign Watch, your agency can uncover the weakest (and strongest) advertisers in any niche and any location. Whether you target one of these underperforming advertisers or you’re talking to an existing prospect, you can come to the pitch armed with real market intelligence, competitor insights, and best-in-class examples to inspire the PPC strategy for your new client.

Sign up for a free iSpionage account to access national and local PPC data and get a snapshot of the competitive landscape for your chosen niche. Upgrade to Starter or Professional for Campaign Watch.